Resources

Lending Expertise

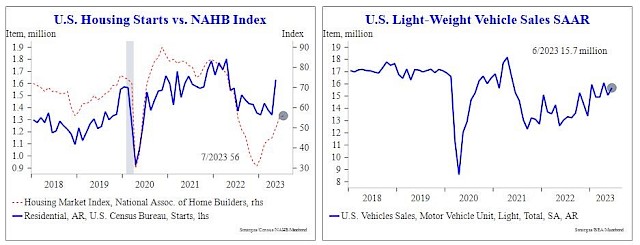

Housing & Autos Preventing a U.S. Recession Now

July 19, 2023

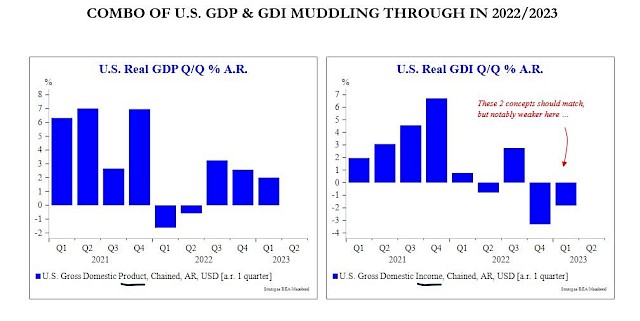

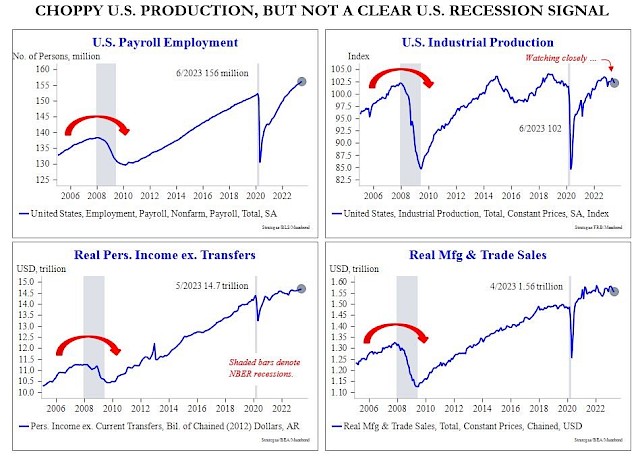

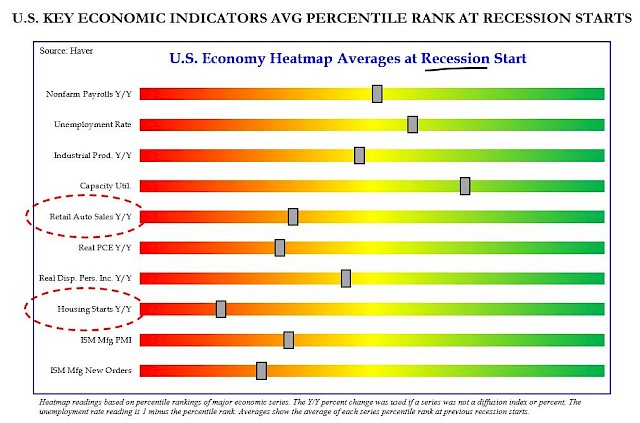

Leading indicators (eg, the yield curve) have been flashing red for a while, and some U.S. sectors have contracted (eg, mfg PMIs < 50, industrial production falling -0.5% m/m in June).

But the U.S. economy overall has been resilient. Retail sales rose +0.2% m/m in June with the retail control group up +0.6%. Tracking estimates for 2Q real GDP in the U.S. are running at roughly +2% q/q A.R.

Bottom line: Recessions are contagion events, and weakness has not yet spread broadly in the U.S. After a choppy 2022, key sectors including housing & autos have shown signs of life in recent months. A recession probably won’t start until those two parts of the economy crack again.

Sources: Don Rissmiller, Strategas

Loan Program Spotlight

Bank Statement Loans

Open the Door to More Self-Employed Clients

Small business owners. Entrepreneurs. Even real estate agents. While self-employed buyers go by many names, they can all find gathering income docs or tax transcripts to be a real hassle. Fortunately, we can offer your clients Bank Statement Loans, allowing them to provide bank statements to qualify for loans up to $3M, with LTVs up to 90% and no MI required. Let’s open the door to more business together.

Latest News

Small Single-Family Homes Rank the Rarest to Find

Another post-pandemic record has been set-just 1% of homes have changed hands this year, the lowest ...

Read More

Read More

Strong US apartment construction suggests slide in rental costs

A surge in U.S. rental home construction could soften rent prices in the months ahead, a much-awaited milestone in the Federal Reserve's effort to tame inflation even as tightening credit conditions are beginning to take the wind out of the apartment building boom.

Read More

Read More

US single-family starts drop; building permits hit 12-month high

U.S. single-family homebuilding fell in June, but permits for future construction rose to a 12-month high as a severe shortage of previously owned houses for sale supports new construction.

Read More

Read More

We do business in accordance with the Federal Fair Housing Law and the Equal Credit Opportunity Act. This letter is for informational purposes only and is not an advertisement to commit to lend or extend customer credit as defined by section 12 CFR 1026.2 Regulation Z. Restrictions and conditions may apply. Terms, rates, data, programs, information, and conditions are subject to change without notice, and may not be available in all areas. Licensed by the Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act, 2315626, Licensed by the Department of Business oversight under the California Residential Mortgage Lending Act, 2111866 or Licensed by the Department of Business Oversight under the California Finance Lenders Law, 2111866. Subject to Borrower Approval.