Resources

Lending Expertise

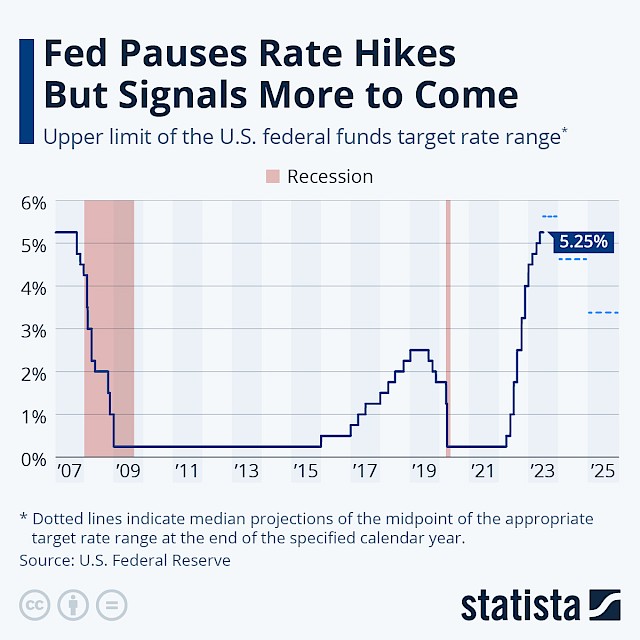

Fed Pause Looks Like A Skip

July 6, 2023

"Almost all" Federal Reserve policymakers backed rate hikes to resume following a pause at the June meeting, expressing concern about the strength in the labor market and "unacceptably high" elevated inflation, according to the Fed minutes of its Jun. 13-14 meeting showed on Wednesday.

"Almost all participants noted that in their economic projections that they judged that additional increases in the target federal funds rate during 2023 would be appropriate," the Fed minutes showed.

In the weeks that followed the June meeting, Fed Chairman Jerome Powell bolstered expectations for the Fed to resume hiking, insisting that monetary policy wasn’t restrictive enough and said he wouldn’t rule out the possibility of hiking rates at consecutive meetings.

The Fed has stressed the importance of allowing the pace of tightening seen so far to filter through the economy and curb inflation, but several Fed members touted "the possibility that much of the effect of past monetary policy tightening may have already been realized," the minutes showed, signaling the need for further rate hikes.

At the conclusion of its previous meeting on Jun. 14, the Federal Open Market Committee kept its benchmark rate in a range to a range of 5% to 5.25%.

But there were some Fed members, according to the Fed minutes, who were in favor of a rate hike at the June meeting, amid concerns about a "very tight" labor market and momentum in the economy.

At the meeting, Fed members upgraded their rate-hike forecast, estimating a terminal rate, or peak rate, of 5.6% at the midpoint in 2023, up from a prior forecast of 5.1% seen in March, suggesting two more hikes ahead.

Call us today to learn more about today's current mortgage rates.

Sources: Yasin Ebrahim, Investing.com | U.S. Federal Reserve

Loan Program Spotlight

FHA & VA Programs with Lower FICO Score

Borrowers with 580 Credit Scores now have more access to great programs and service!

FHA loans are available to all U.S. Citizens who qualify and VA loans are available to veterans, active-duty military's personnel, and surviving spouses who qualify.

Latest News

Fed meeting minutes to offer clues on future rate hike appetite

Federal Reserve meeting minutes from the June policy gathering to be released on Wednesday are likely to show an active debate among policymakers who still on balance appear inclined to support more action to tame inflation.

Read More

Read More

Q2 Affordability Worsens Nationwide as Home Prices Elevate

ATTOM has released its Q2 2023 U.S. Home Affordability Report showing that median-priced single-fami...

Read More

Read More

FHA Raises Multifamily Large Loan Threshold

This change will increase the number of multifamily loans that are eligible for standard underwriting for FHA insurance - loans above the "Large Loan Threshold" must meet additional requirements.

Read More

Read More

We do business in accordance with the Federal Fair Housing Law and the Equal Credit Opportunity Act. This letter is for informational purposes only and is not an advertisement to commit to lend or extend customer credit as defined by section 12 CFR 1026.2 Regulation Z. Restrictions and conditions may apply. Terms, rates, data, programs, information, and conditions are subject to change without notice, and may not be available in all areas. Licensed by the Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act, 2315626, Licensed by the Department of Business oversight under the California Residential Mortgage Lending Act, 2111866 or Licensed by the Department of Business Oversight under the California Finance Lenders Law, 2111866. Subject to Borrower Approval.